Is there a way to access valuable trading insights at a reduced cost? A promotional code for discounted access to trading ideas holds the key.

A promotional code, often a series of letters and numbers, can grant reduced pricing on access to trading ideas. These ideas might involve specific strategies, market analysis, or predicted stock movements. Imagine a curated collection of expert trading insights available at a lower price point; the promotional code facilitates this. This code can be used during the checkout process to unlock discounted access. An example would be a code like "TRADESMART10" used to obtain 10% off a premium trading strategy service.

Such codes offer significant value by providing access to potentially lucrative opportunities at a lower barrier to entry. Lower costs can make trading ideas accessible to a wider range of individuals, fostering a more competitive and informed marketplace. The availability of discounted access often demonstrates a commitment to broader market participation. Historical precedent often involves companies offering these codes to attract new subscribers or reward loyal customers. Ultimately, a discount code can improve access to market insights and potentially increase opportunities for financial gain.

Now let's delve into the specifics of how these codes are structured and what factors impact their effectiveness.

Trade Ideas Discount Code

Understanding the elements of a trade ideas discount code is crucial for accessing valuable market insights at a reduced cost. This involves various factors influencing its effectiveness and applicability.

- Promotional Value

- Code Structure

- Validity Period

- Access Restrictions

- Terms & Conditions

- Provider Reputation

- Market Volatility

- Discount Amount

A trade ideas discount code's value hinges on the promotional offer's strength and intended audience. Code structure, typically alphanumeric, is essential for verification. Validity periods constrain the code's applicability. Access restrictions might apply to specific asset classes. Terms and conditions outline stipulations, including user limitations. A reputable provider enhances trust. Market conditions impact the relative effectiveness of trading ideas. The discount amount directly affects the financial incentive. Ultimately, a strong discount code combines various aspects, ultimately determining its value proposition within the context of the broader financial market.

1. Promotional Value

Promotional value directly impacts the desirability and utility of a trade ideas discount code. A strong promotional value proposition is essential for attracting users and maximizing the code's effectiveness. This facet encompasses the perceived worth of the discounted access to trading ideas, influencing whether individuals view the offer as worthwhile and likely to yield a positive return.

- Discount Magnitude

The percentage or monetary amount of the discount directly affects the promotional value. A substantial discount, such as 50% off a premium trading service, typically presents a more attractive proposition than a smaller one. This quantitative element is a core component of the appeal.

- Value of the Underlying Service

The inherent value of the trading ideas offered significantly impacts the perceived promotional value. A reputable service providing high-quality, actionable trading ideas will command a higher promotional value, even with a smaller discount. Conversely, a service lacking in substance will not be as compelling, even with a larger discount. The quality of the data and insights is a key driver.

- Duration of the Offer

A limited-time offer often increases the promotional value. The scarcity created by a time-bound discount can incentivize faster engagement and adoption. The sense of urgency can motivate users to act quickly, potentially amplifying the value of the discount.

- Targeting of the Offer

The specificity of the target audience to which the promotional offer is directed influences the overall value. A discount code designed for established traders might carry less promotional value to a novice investor compared to a code for novice investors tailored to their specific needs.

In conclusion, the promotional value of a trade ideas discount code is a multifaceted concept. A strong discount, coupled with high-quality insights and a clear target audience, will present a more compelling proposition. These interconnected elements ultimately determine the effectiveness of the code in attracting and retaining users.

2. Code Structure

The structure of a discount code significantly impacts its functionality and security within the context of trade ideas access. A well-designed code structure aids in verification and avoids potential misuse. Understanding its components is crucial for users seeking to leverage these codes effectively.

- Character Set

The character set employed in the code directly affects its complexity and security. Codes relying on alphanumeric characters (letters and numbers) are generally more readily verifiable compared to more complex character sets. The inclusion of special characters can enhance security but may complicate memorization for users. Codes like "TRADERSAVE10" are relatively straightforward, while others may use more intricate combinations.

- Length and Complexity

The length and complexity of the code influence its susceptibility to unauthorized use. Longer, more complex codes generally offer better security. However, excessively long codes can prove cumbersome for users to remember and input. A balance between security and usability is critical. A simple code like "SUMMER20" might be easily remembered but less secure than a longer code.

- Structure and Pattern

The specific pattern or structure within the code plays a crucial role. Consistent patterns can enhance recognition but also increase the likelihood of unauthorized code generation. The predictable nature of some codes might be exploited. For instance, a code structured with a prefix and a suffix, such as "PROMO-JULY2023," is often used.

- Verification and Validation

The verification and validation mechanisms for the code strongly influence its usability and prevent fraudulent use. A well-defined validation process using a unique identifier ensures accuracy and reduces the risk of errors. A robust system checks the code's validity against the underlying database of activated promotional codes.

In conclusion, the structure of a trade ideas discount code significantly influences its security, usability, and potential for misuse. A well-considered structure incorporates elements of complexity, predictability, and validation processes to enhance security while maintaining user-friendliness. The choice of character set, length, and pattern must be carefully considered to create a secure and effective promotional code.

3. Validity Period

The validity period of a trade ideas discount code is a crucial component, directly impacting its usability and effectiveness. A code's timeframe dictates when it can be utilized to access discounted trading insights. This timeframe, often specified in days, weeks, or months, serves a practical purpose, preventing the code from becoming outdated. Understanding this temporal constraint is critical for maximizing the value derived from the discount code. A code expiring too soon diminishes its usefulness, while an unreasonably long validity period might reduce its value in the face of changing market conditions.

Practical applications highlight the importance of understanding validity periods. Consider a discount code for a comprehensive trading strategy course. If the code expires in a month, students wanting to take advantage of the discount will need to act quickly. Conversely, if the same code had a validity period spanning years, its promotional incentive might diminish due to the diminished scarcity and the dynamic nature of trading strategies over extended periods. A well-structured validity period aligns the code's value with the market's dynamic. For example, seasonal offers like a back-to-school promotion for trading ideas might only remain valid during the specific timeframe of the back-to-school season. This aligns the code's utility directly with market trends and participant expectations.

In summary, the validity period of a trade ideas discount code is a critical factor in determining its practical application. Understanding this temporal constraint is essential for maximizing the value proposition of the code while ensuring it remains relevant to the current market context. Strategic alignment between the code's validity period and the targeted market dynamics enhances its effectiveness. The code's time-sensitive nature creates a sense of urgency for users, prompting prompt action and enhancing the likelihood of successful utilization. Failure to account for the expiry date can result in the code becoming useless, highlighting the importance of attention to detail and time management when using such promotional tools.

4. Access Restrictions

Access restrictions associated with trade ideas discount codes are a crucial component for managing access, security, and the overall value proposition of the offered content. These restrictions often delineate specific user groups, limiting access to individuals who meet predetermined criteria. This structured approach allows providers to target their promotional efforts effectively and maintain control over the quality and integrity of the provided trading insights. Implementing access restrictions can significantly reduce the potential for misuse, ensuring that the discount code is applied appropriately. Restrictions can dictate factors such as account type, experience level, or geographic location.

Real-life examples highlight the practical significance of these restrictions. A discount code for advanced trading strategies might be restricted to accounts holding a certain minimum investment or demonstrating a specific level of trading experience, thus preventing novice investors from potentially detrimental trading choices. Similarly, geographic limitations ensure that promotional offers align with regulatory requirements, market accessibility, and trading infrastructures. A discount code for an international stock market analysis service may only be available to users in compliant jurisdictions. These examples demonstrate how tailored restrictions can maintain the integrity and intended value of the trade ideas being offered. Such control helps foster a more disciplined and informed investing environment.

In conclusion, access restrictions are integral to the effective management of trade ideas discount codes. They allow for targeted access, maintain service quality, safeguard against misuse, and ensure alignment with regulatory and market realities. Understanding these restrictions is paramount for individuals seeking to leverage discount codes and for providers striving to deliver valuable insights responsibly. This strategic framework ensures the code's utility and relevance within the context of the broader financial market.

5. Terms & Conditions

Terms and conditions (T&C) play a crucial role in regulating the usage of trade ideas discount codes. These documents outline the stipulations governing the code's application, ensuring a fair and transparent process for both providers of trading insights and users seeking to access them at a reduced cost. Understanding these terms is essential to avoid potential conflicts or misunderstandings.

- Limitations on Usage

T&C often specify limitations on how the discount code can be utilized. These might include restrictions on the types of accounts or services to which the code applies. For example, a code might be valid only for new subscribers or for a specific product line, and ineligible for use with existing subscriptions. Understanding these restrictions is paramount to avoid wasted effort in applying the code inappropriately.

- Validity Period & Expiration Dates

T&C clearly define the timeframe during which the discount code remains valid. Failure to adhere to the expiration date renders the code unusable. These limitations prevent misuse and ensure that offers remain timely. Examples include codes valid for a certain number of days or a fixed period following the date of purchase.

- Restrictions on Transferability

T&C often prohibit the transfer or resale of discount codes. These clauses prevent unauthorized individuals from gaining access to the discounted service. Examples might involve clauses prohibiting the sale or gifting of the code to other individuals, effectively safeguarding the promotional offers integrity. This also prevents market manipulation or abuse.

- Governing Law & Dispute Resolution

T&C typically specify the governing jurisdiction and dispute resolution processes. This clarifies the legal framework for any potential issues arising from the use of the discount code. These clauses address the legal mechanisms and pathways to resolve disagreements related to the code's application.

In summary, T&C act as a crucial contract governing the use of trade ideas discount codes. Their clear articulation of limitations, validity periods, and transfer restrictions ensures fairness, transparency, and a defined scope for code application. A thorough review of the T&C is imperative to ensure compliance with these terms and avoid any misunderstandings regarding the terms of the promotional offer. By adhering to these terms, users can maximize the benefits while providers can maintain control over the discounted access.

6. Provider Reputation

Provider reputation is intrinsically linked to the value and effectiveness of a trade ideas discount code. A reputable provider, with a history of delivering accurate and insightful analysis, often commands greater trust and value. Investors are more likely to engage with discounted access to trading ideas originating from a known, reliable source, as opposed to a less reputable entity. The perceived quality of the trading ideas directly correlates with the provider's established track record and public perception.

Consider a well-known financial news outlet offering discounted access to its market analysis. The established reputation of the news outlet lends significant credibility to the associated trading ideas. Conversely, a relatively unknown entity offering similar discounted insights may face skepticism, despite attractive pricing. Past performance and consistent delivery of accurate market analysis are critical components of this reputation. The reputation established over time influences the perceived value of the discount itself. A recognized provider enhances the trustworthiness of a discount code and subsequently increases its appeal to potential clients, regardless of the percentage reduction.

Understanding this connection is crucial for investors. A strong provider reputation enhances the trustworthiness and potential return on investment associated with a discounted trade ideas access. Conversely, a lack of reputation can signal a higher risk, even at a significantly reduced cost. Investors must therefore carefully assess a provider's history and track record before relying on discounted trade ideas, ensuring alignment with their investment strategies. Reputation, in this context, is a key indicator of the reliability and value of the insights delivered, ultimately affecting the success of the trading strategy.

7. Market Volatility

Market volatility, characterized by significant and rapid price fluctuations, directly impacts the effectiveness and perceived value of trade ideas discount codes. High volatility often necessitates timely and adaptable trading strategies, potentially diminishing the value of static or outdated ideas. Codes offering access to strategies that lack flexibility may prove less beneficial during periods of unpredictable market movements.

The importance of market volatility as a component of evaluating trade ideas discount codes lies in its ability to influence the accuracy and relevance of the offered insights. During periods of extreme volatility, the predictive power of historical data diminishes, potentially rendering static trading ideas less effective. Codes that offer access to real-time analysis and adaptive strategies often prove more valuable in dynamic market environments. Consider a discount code for a service that provides short-term, high-frequency trading signals. In periods of high volatility, such codes will likely generate more immediate and pertinent information compared to a code that provides long-term investment recommendations. In contrast, a code for a dividend-growth strategy might yield less value during a turbulent market experiencing widespread drops in stock prices.

Understanding the connection between market volatility and trade ideas discount codes allows for a more nuanced evaluation. Investors can assess the adaptability of the offered strategies and the service's responsiveness to changing market conditions. Codes linked to dynamic analysis, tailored to real-time market volatility, often demonstrate a stronger value proposition. Conversely, during periods of low volatility, the value proposition of a robust, real-time analysis-driven service may diminish slightly, as static, long-term strategies may yield better results in a less dynamic environment. In practice, evaluating the provider's track record during periods of high market volatility provides vital insight into the quality and adaptability of the offered trade ideas. This understanding empowers informed decision-making and allows for more strategic utilization of discount codes within the context of dynamic market forces.

8. Discount Amount

The discount amount associated with a trade ideas discount code is a critical factor influencing its attractiveness and potential value. The magnitude of the discount directly affects the perceived desirability of accessing trading insights. A substantial discount can incentivize wider adoption, particularly in competitive markets, but this value is contingent on the quality and relevance of the underlying trading ideas. A large discount paired with poor-quality insights offers limited benefit, while a modest discount tied to high-quality ideas can prove a strong value proposition. The relationship isn't simply linear; various contextual factors play a role.

Real-world examples illustrate the interplay of discount amount and trade idea value. A substantial discount on a comprehensive trading course from a reputable financial institution might significantly attract new subscribers, but a small discount on a similar course from a less established provider might not yield the same level of engagement, especially if the quality of the course content is questionable. Conversely, a modest discount on a well-regarded provider's real-time market analysis service can incentivize subscriptions, potentially surpassing a significantly larger discount on an inferior service. The discount's impact is interwoven with the perceived value of the associated trade ideas. A substantial discount can highlight perceived value, but this perception is not guaranteed without demonstrable, high-quality insights. In practice, the discount amount must be thoughtfully considered in the context of the service's inherent value to maximize its effectiveness.

In conclusion, the discount amount associated with a trade ideas discount code is a significant component of its overall appeal but not the sole determinant of value. The effectiveness of a discount code depends on the interplay between the discounted price and the perceived quality of the underlying trading ideas. A well-considered approach to discount magnitude, coupled with strong analytical content and a reputable provider, is likely to yield the most positive outcomes for both providers and users. A strategic perspective encompassing both the discount amount and the quality of trade ideas is crucial for optimal use and engagement within the market.

Frequently Asked Questions about Trade Ideas Discount Codes

This section addresses common inquiries regarding trade ideas discount codes, offering clear and concise answers to help users understand the nuances of these promotional offers. Understanding the terms and conditions associated with these codes is crucial for responsible and effective utilization.

Question 1: What is a trade ideas discount code, and how does it work?

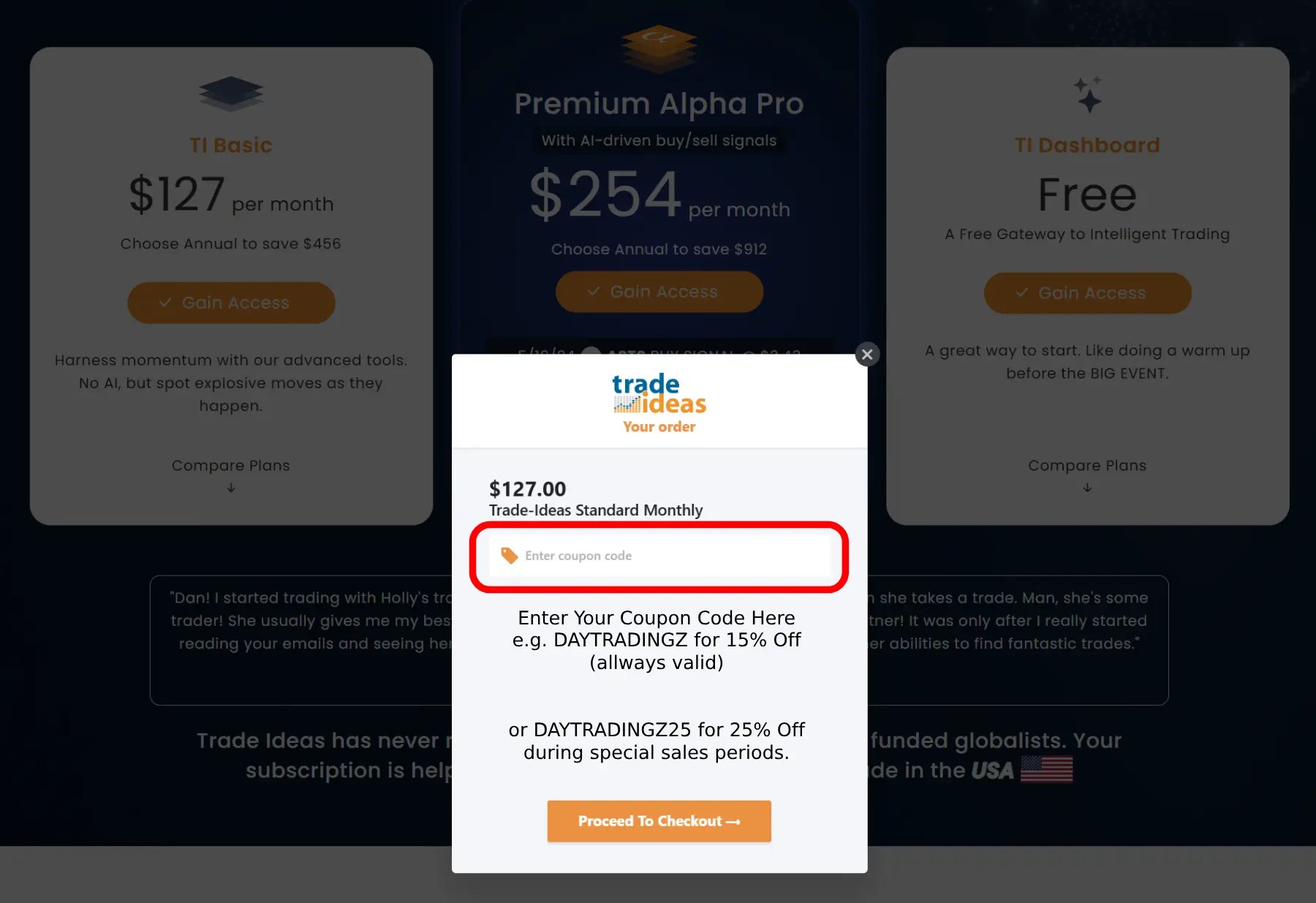

A trade ideas discount code is a unique alphanumeric string that provides reduced access to trading ideas, strategies, or insights. The code is entered at checkout or during the registration process to unlock the discounted price. Codes typically offer a reduction on premium services or content related to trading insights.

Question 2: How can I find trade ideas discount codes?

Discount codes can be found through various channels, including online promotional websites, social media, the provider's official website, or through email newsletters. Some providers may also release codes through partnerships or collaborations. Regularly checking these sources can increase the chances of discovering applicable codes.

Question 3: What are the typical limitations or restrictions associated with using a trade ideas discount code?

Limitations can vary but commonly include expiration dates, restrictions on account types or service access, limitations on the number of times a code can be used, and exclusions on certain products or services. Careful review of terms and conditions is crucial to ensure compliance with any limitations.

Question 4: Are there any risks associated with using trade ideas discount codes?

Risks can arise from utilizing fraudulent or expired codes. Using invalid codes might result in a loss of access or payment and will not result in the promised discount. Ensure the code's validity and verify the legitimacy of the provider before use.

Question 5: How can I maximize the value of a trade ideas discount code?

To maximize the value, users should carefully evaluate the terms and conditions, paying particular attention to the expiration date and any limitations on code usage. Furthermore, understanding the quality and applicability of the offered trading ideas based on the provider's reputation and past performance is vital to maximizing the benefits derived from the code.

Understanding these aspects ensures responsible use of discount codes and allows users to leverage promotional offers effectively while minimizing potential risks. By staying informed and vigilant, investors can make more informed decisions when considering trade ideas discount codes. This will potentially help optimize their investment strategies.

Next, we will explore the various factors that influence the effective use of these promotional codes.

Conclusion

The exploration of trade ideas discount codes reveals a complex interplay of factors influencing their effectiveness and value. Key elements, such as the promotional value, code structure, validity period, access restrictions, and provider reputation, interact dynamically. Market volatility and the discount amount further shape the code's perceived value. A thorough understanding of these interwoven components allows for a more nuanced evaluation, enabling informed decisions regarding the utilization of such promotional tools. Ultimately, the success of these codes hinges on the alignment between the code's features and the user's investment objectives.

While discounted access to trading ideas can present attractive opportunities, investors must exercise due diligence. Careful consideration of the provider's reputation, the code's terms and conditions, and the overall market context is paramount. A comprehensive understanding of market dynamics and the inherent limitations of any predictive tool is essential for mitigating risks and maximizing the potential returns. The prudent use of trade ideas discount codes, alongside a robust understanding of individual investment strategies and risk tolerance, forms a crucial component of successful financial planning.

Sprx Holdings: Investing In The Future

BlackBerry Stock Price: Latest Updates & Analysis

71 Days From Now: Exciting Events & Plans

![Trade Ideas Stock Scanner Review [2021] Warrior Trading](https://i2.wp.com/media.warriortrading.com/2016/05/Trade-Ideas-4-2048x1110.jpg)